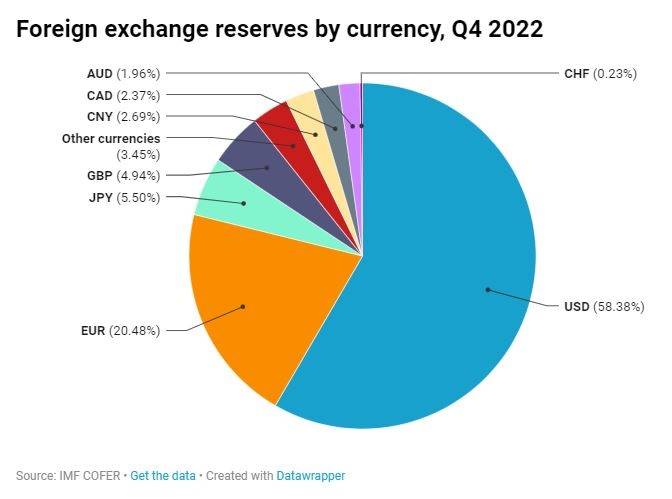

Last month, official data revealed a significant milestone for Beijing in its efforts to internationalize the yuan. In March, the yuan surpassed the dollar as the most widely used currency for cross-border transactions in China. While this achievement may seem promising, a closer examination underscores the challenges China faces in its ambition to replace the dollar as a reserve currency. Simply desiring the change and employing astute diplomatic efforts will not be sufficient.

There are several reasons why it may be impossible to shift major global trade away from the dollar and towards the yuan under current circumstances. Bloomberg data reveals that while the use of the yuan is growing, the currency’s share of global trade finance has only tripled in the last three and a half years, representing a small portion of global transactions. This is partly because the yuan is still tightly controlled by Chinese authorities, and there are restrictions on its use in areas such as cross-border loans and portfolio investments.

One of the main challenges facing the yuan is that it is not fully convertible, and there are limitations on the variety of renminbi-based investment products. For the yuan to become a fully international currency, China would need to allow greater freedom for the currency and inward as well as outward investment. This would require China to deepen its capital markets and open up its capital accounts, which would be a significant challenge for the country’s authorities given their reluctance to relinquish control of their capital markets.

Furthermore, China’s lack of deep, free markets is also a significant hindrance to its ability to take on the dollar or euro as the global currency of choice. China’s financial offerings still struggle to compete without the depth of capital markets that the US and Europe have. Without deep capital markets, it can also be challenging to move money in and out of the country, making it less attractive for global investors.

The use of the yuan in global finance has also been boosted by sanctions that have ensnared Moscow following its invasion of Ukraine. Russia has embraced the yuan for trade, private savings, and foreign-exchange transactions, and the yuan has replaced the dollar and euro as the most traded currency across the nation. However, Russia’s move toward the yuan was driven more by necessity than by choice, as it was left with very few options following the sanctions.

Moreover, while the use of the yuan is growing in some parts of the world, such as in Russia and in transactions that don’t involve China, there is still a significant amount of inertia that stems from sticking with the prevailing reserve currency. The US dollar has been the dominant global reserve currency for decades, and it will take more than just a few years of yuan growth to change that.

With slowing growth and a retreating push for freer trade, China’s position within the global economy has been shifting in recent years. This has motivated Chinese leaders to accelerate the process of transforming their country into a new centre for global banking, commerce, and investment. It remains highly questionable, however, whether China’s efforts will be sufficient to create a significant shift away from the dollar and towards the yuan in the near future, given the enormous element of control being exerted by the government.

0 Comments