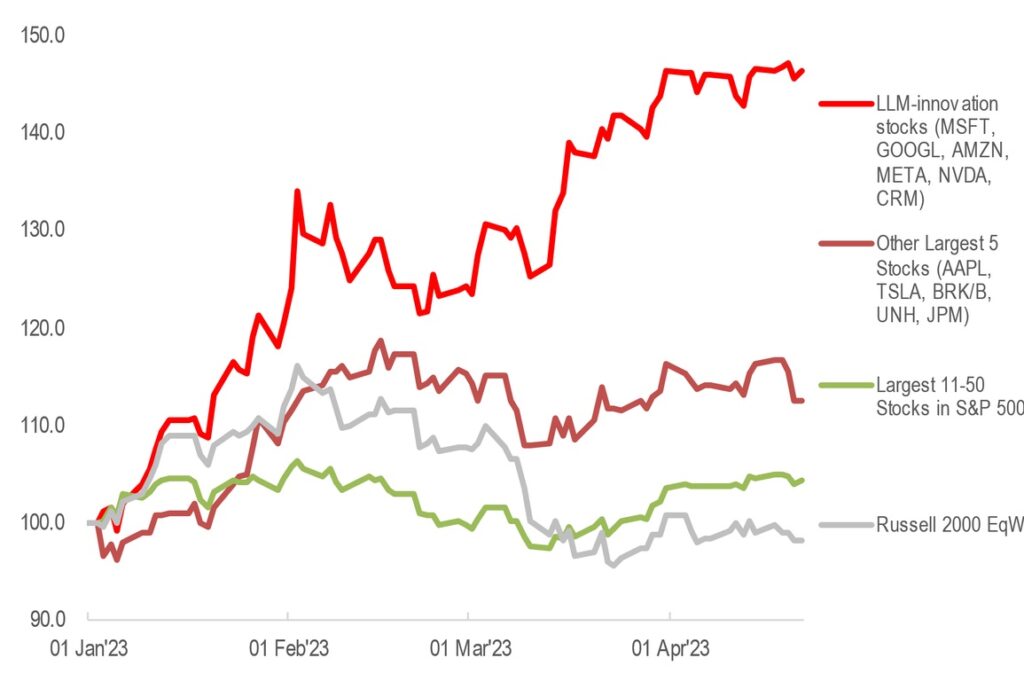

According to a recent JPMorgan study, ChatGTP and other artificial intelligence (AI)-powered large language models (LLMs) contributed $1.4 trillion to the value of companies and accounted for more than half of the S&P 500’s gains. Microsoft, Alphabet (parent company of Google), Amazon, Meta Platforms, Nvidia, and Salesforce.com are among the LLM-innovation stocks analysed in this report.

In addition, the JPMorgan team claims that the rise of AI and the subsequent flight to safety have created the narrowest stock leadership in an up market since the 1990s. They see this as a possible precursor to a sluggish cycle or economic downturn.

However, ChatGPT’s meteoric rise in the AI space begs the question: what exactly is AI, and how will it affect the economy as a whole? The OpenAI-trained ChatGPT language model is able to produce natural-sounding responses to natural-language queries. A transformer, a type of deep neural network architecture, is used to learn the patterns and associations between words, phrases, and sentences from a large corpus of textual data. The end result is an artificial intelligence system that behaves like a human when responding to questions.

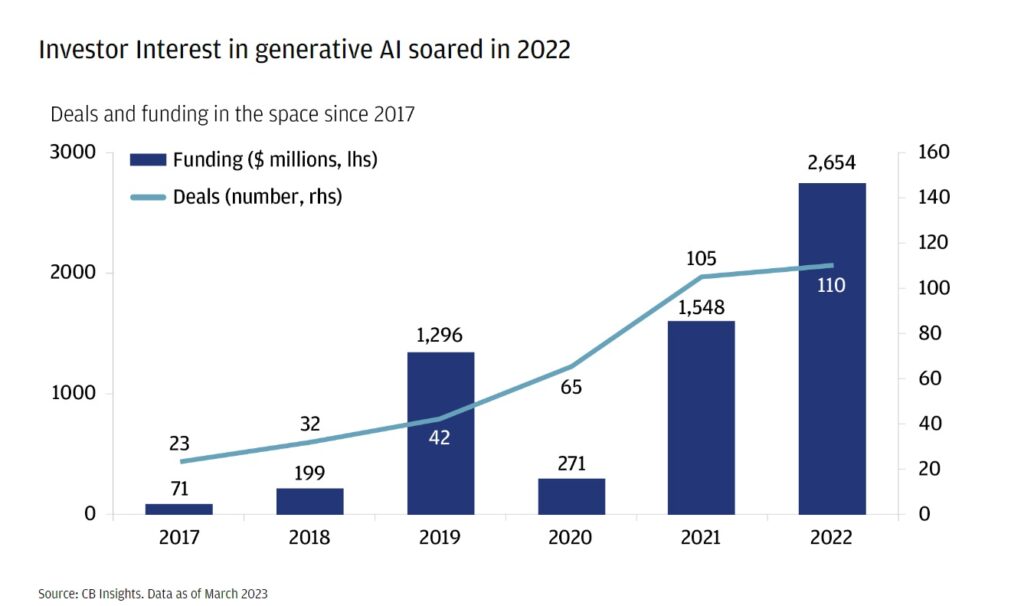

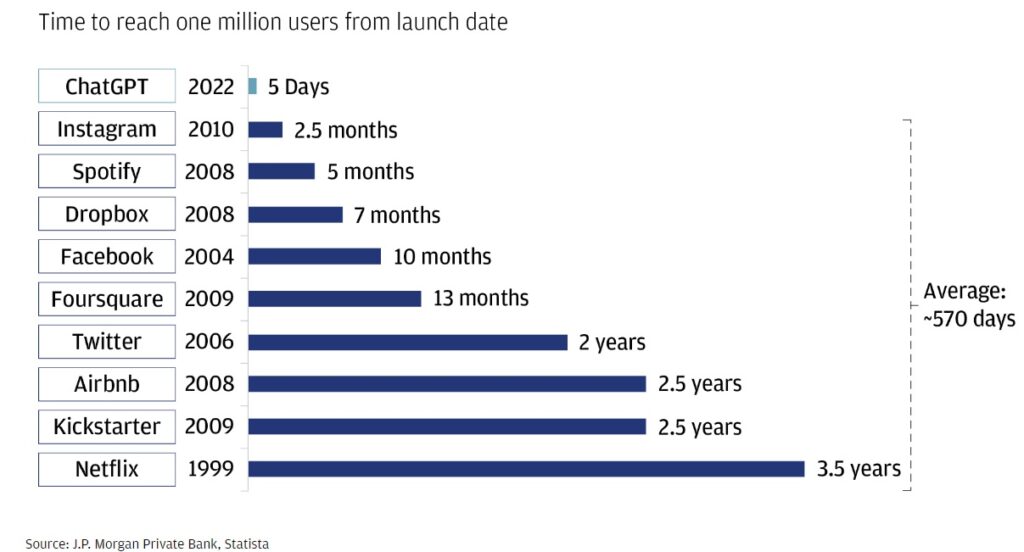

ChatGPT has been a media sensation ever since its release in November 2022. It was the fastest-growing platform in history, gaining one million users in a short amount of time. In January of 2023, this number jumped to 100 million users. LLMs have the potential to revolutionise our approach to routine tasks and boost our productivity. As a result, based on the interest from investors generated during the last year, AI is expected to attract a lot of funding, with the majority of the money going towards consumer-facing products that incorporate AI models, proprietary models that power consumer-facing products, and supporting infrastructure.

The potential impact of ChatGPT and other LLMs on the economy is significant: automation of a wide range of tasks, from customer service to content creation, data analysis, and much more. They can also facilitate better communication, streamline operations, and boost output. LLMs can be used to automate processes like fraud detection and prevention, risk assessment, and compliance monitoring in the financial sector.

However, the widespread adoption of AI could also have significant implications for the labour market. While it may create new jobs in the tech industry, it could also eliminate traditional jobs in sectors such as customer service, content creation, and data entry. For instance, this week, thousands of TV and film writers have been picketing in Los Angeles and New York City, calling for job security, and limits on the use of artificial intelligence in the creative process.

There are also concerns about the potential misuse of AI, particularly in areas such as surveillance and data privacy. As LLMs become more advanced, they could be used to manipulate public opinion or perpetuate existing biases. This could have significant implications for democratic processes and social cohesion.

To maximize the benefits of AI while minimizing the risks, it is essential to have strong governance and ethical frameworks in place. This includes ensuring transparency in AI decision-making processes, addressing bias in algorithms, and protecting data privacy. It also involves investing in education and training to ensure that people have the skills necessary to participate in the digital economy.

Clearly, these are not ordinary times. The AI revolution has ushered a new era of unprecedented technological advancements and has disrupted traditional industries in ways that were once unimaginable. From the rapid rise of ChatGPT to the potential implications of widespread AI adoption, it is a drama that no Hollywood script could match.

0 Comments