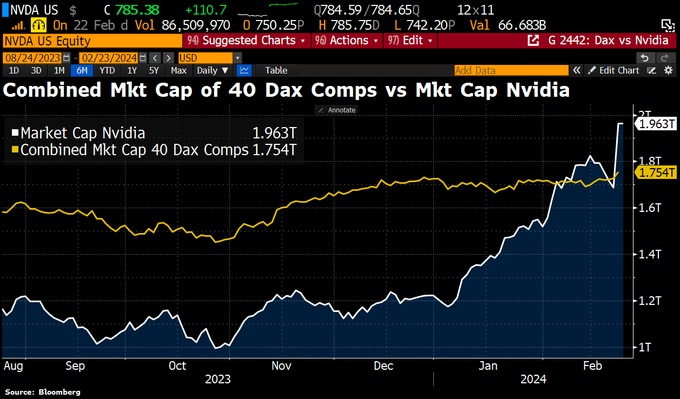

Nvidia, the prominent chip manufacturer with operations in Israel, has once again surpassed market expectations, causing ripples of astonishment throughout Wall Street. In the latest financial report, Nvidia reported a staggering 265% increase in revenue compared to the previous quarter and a notable annual jump of 126%. The company’s stock soared by 16%, adding a whopping $270 billion to its market value, securing its position as the third-largest entity on Wall Street, with a valuation of $1.93 trillion. The media frenzy surrounding Nvidia’s achievements has been palpable, with headlines declaring it as the new powerhouse of the market. Notably, as of the time of writing, the combined market capitalization of Nvidia exceeded the total value of the German DAX index, comprising 40 of the largest companies, some of which have histories spanning 130 years.

Image credit: Bloomberg

Analysts and media outlets alike are hailing Nvidia’s success as a testament to its leadership in artificial intelligence (AI) chips. The Wall Street Journal proclaims, “Nvidia’s profits electrify the market,” suggesting that the company’s stellar performance is driving record-breaking gains not only for itself but also for broader market indices like the Nasdaq and the S&P 500. Nvidia’s influence transcends borders, as evidenced by the surge in global indices such as the Nikkei and the Stoxx European stock index.

CNBC analyst Zev Fima acknowledges that Nvidia’s stock is priced with lofty expectations, but the company consistently delivers on its promises. The New York Times dubbed Nvidia as “the queen of artificial intelligence chips,” emphasizing its pivotal role in driving the AI revolution. Indeed, Nvidia seems to be riding the wave of AI innovation while simultaneously propelling it forward.

Having said all that, despite the tangible excitement, significant concerns about a potential bubble are already here. Hedge funds are pulling back, analysts caution about high expectations, and comparisons to the dot-com boom are already causing concern. As analysts raise their growth projections for Nvidia, the company faces increasing pressure to meet or exceed these lofty expectations. Amidst these concerns, questions loom about the sustainability of Nvidia’s meteoric rise and its implications for broader market dynamics.

To comprehend Nvidia’s achievement, we need to look deeper than just the headlines. Is its chip expertise actually unparalleled? How does the company look relative to AMD and Intel? What about its expansion into gaming and other areas such as driverless vehicles? These inquiries are crucial for comprehending its sustainability in the long run.

In conclusion, Nvidia’s recent performance has undoubtedly captured the attention of investors and analysts worldwide, reaffirming its status as a dominant force in the chip industry. With remarkable revenue surges and unprecedented stock market gains, Nvidia has cemented its position as a key player in driving technological innovation, particularly in the realm of artificial intelligence.

However, amidst the celebrations, it’s imperative to address the underlying concerns regarding the sustainability of the company’s growth trajectory. The cautionary whispers of a potential bubble in the AI sector are becoming louder, prompting investors to reassess their positions. As Nvidia faces mounting pressure to continually exceed market expectations, the spotlight is now on the company’s ability to navigate these challenges while maintaining its competitive edge.

Image credit: Jensen Huang, CEO of Nvidia. Shutterstock

0 Comments