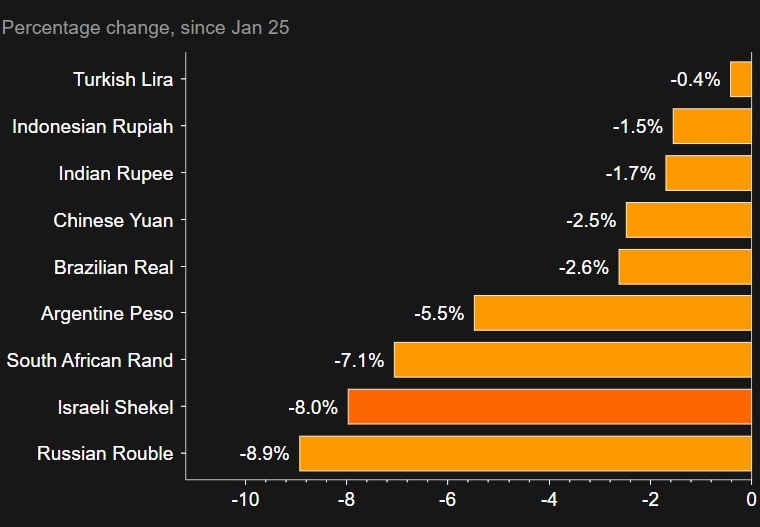

The recent depreciation of the shekel against foreign currencies has sparked speculation that the Bank of Israel will intervene in the foreign exchange market. The shekel has fallen by 8% against the dollar in just over a month since the government’s push for judicial reform, which could have significant consequences for Israeli inflation. Some reports claim that the Bank of Israel has already sold dollars to counteract this trend, while others suggest that intervention may be forthcoming.

The Bank of Israel has two primary reasons for intervening in the foreign exchange market. The first is to moderate and calm the market during times of high volatility in exchange rates. The second is to reduce deviations from the bank’s preferred nominal exchange rate trend. The bank has a significant amount of money, with foreign currency balances increasing by more than 8% since September 2022, to approximately $195 billion. These balances are kept as a reserve in case of economic emergencies or currency collapse. When the bank holds excess balances, it can sell dollars to stabilize and mitigate market fluctuations.

Despite speculations about the Bank of Israel’s intervention, according to some media reports, the bank has not yet intervened. However, the option remains open and may be presented as a viable option later this year. The last time the bank had to step in on the foreign exchange market was in March 2020 during the Corona crisis, when the shekel fell by 10%.

Intervention in the foreign exchange market can have both positive and negative consequences. On the one hand, it can stabilize the market and bring certainty. On the other hand, the Bank of Israel has finite foreign exchange reserves, which, if depleted, could lead to a currency collapse.

According to experts, the current situation is the result of a political effect, and therefore, the bank’s intervention is unlikely to solve the problem.

Goldman Sachs believes that the shekel’s depreciation reflects an 8% risk premium that did not exist two months ago, and is short-term. The bank will not intervene until the situation stabilizes. Wells Fargo Bank, however, is bullish on the shekel, predicting that the Bank of Israel’s intervention will restore order, resulting in a sharp rise in the shekel.

Having said that, while the Bank of Israel may intervene in the foreign exchange market to counteract the depreciation of the shekel, the consequences are unknown. The bank’s foreign exchange reserves are limited, and intervention may not solve the underlying problem. What can make a difference is the government’s willingness to reach a compromise and pass judicial reform that is acceptable across the political spectrum. If this scenario plays out, the Bank of Israel may simply focus on other more pressing issues that fall within its scope.

0 Comments