The Israeli real estate market is dealing with a new economic reality: high interest rates that have not been seen in a decade. The number of transactions has been rapidly declining over the last six months, as there are now fewer buyers on the market due to an increase in mortgage costs and the availability of alternative means of earning fixed income with a competitive yield.

Recently published data by the Central Bureau of Statistics (CBS) indicates a very unpleasant trend taking place in the sector: a ratio between the number of apartments entering the market to be sold and the number of units remaining at the end of a given month continued to climb. These statistics demonstrate the depth of the developing crisis that the local real estate sector has been facing in recent months.

The report reveals that property developers are dealing with difficulties in selling their inventory. This current situation is in some ways reminiscent of the environment of the 2008 market.

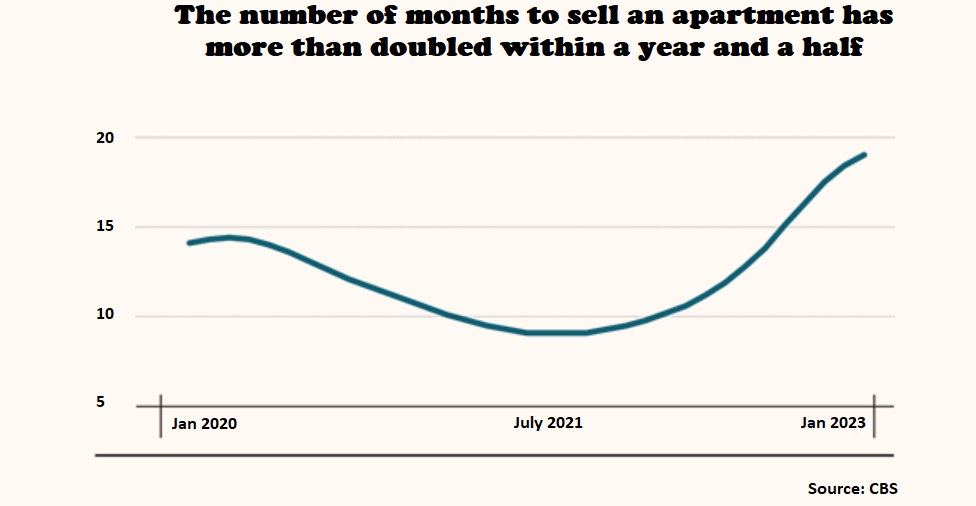

Even with the Corona closures that took place in 2020, sales of new apartments remained steady at around 41,000 units. The average number of months to sell a new apartment dropped from 19.6 at the start of 2019 to just 10.9 by the end of 2020. In 2021 there was a dramatic spike in apartment sales, with 58,000 units sold. The result was that a brand-new apartment stayed on the market only for nine month. But the monthly amount of sales of new apartments began to drop rapidly at the end of 2021, a few months before the series of interest rate hikes took place during 2022. Local experts anticipate the number of properties sold last year to be in the region of 39,500 units. Should this number be officially confirmed, it will mark a decrease of over 30% compared to the 2021 record.

According to the most recent data, the apartments are on the market for about nineteen months after their original listing date, or roughly twice as long as they were at the peak of the market, a level last seen in 2019.

The latest trend expresses a potentially perilous combination of a rapid increase in the number of months it takes to sell the property and the rising cost of keeping it on the market. This is not the scenario real estate players have been envisioning. And clearly, a substantial increase in their inventory and lack of activity was not something they were making provisions for, as the property market of twelve months ago was on a solid trajectory to continue rising in value. Therefore, it is time for real estate developers to prepare for any additional deterioration in the market. And for now, they can only rely on the financial cushion they managed to accumulate in the form of hefty profits during the “years of plenty.” However, this may not bring much solace to people who gambled by taking on more debt than they should have during the period of low interest rates.

0 Comments