By all standards and measures, there is no doubt that this year is abounding with economic challenges. Main stock markets have been treading in bear market territory for some time now. And it is not surprising as the risk of a global recession becomes ever more real. However, stocks are not the only assets that are having a bad time. Bonds appear to be in a worse place when you look at the historical data.

According to the figures, this year has been the worst for bonds since at least 1926. And according to one expert on bonds, 2022 is shaping up to be the worst year for bonds since accurate records began.

Having said that, despite all the doom and gloom, bond investors will start feeling better once interest rates stop climbing. Simply put, buying bonds at current levels has a good chance of making a decent return in the future. At least this is what we can see from history and simple fixed-income calculations, combined with plenty of patience to hold on to one’s holdings in the face of stock market turmoil.

For over hundred years the stock markets managed to deliver consistently solid results over the long term. This is not to say there were no recessions or bear markets. However, for variety of reasons, mainstream media is inclined to report excessively about financial crashes and consequent short term losses that end up dominating news coverage.

When it comes to bonds, including the one issued by government, the anticipation is that they are supposed to serve as a safety net against stock market losses and a source of fixed income that provides investors with a steady stream of cash. However, this year proved to be anything but that.

The last nine months saw bonds across the globe been affected in a way that even most conservative investors did not see it coming. Since bond prices and its yields move in opposite directions, the sharp increase in interest rates by central banks has naturally resulted in significant declines in bond prices.

As a result of high inflation, the Federal Reserve had to raise the interest rate to levels not seen in over a decade, which led to paper losses of investment portfolios. In England, the central bank had to step in to stave off the panic selling as government bonds took large losses following the government’s announcement of tax cuts.

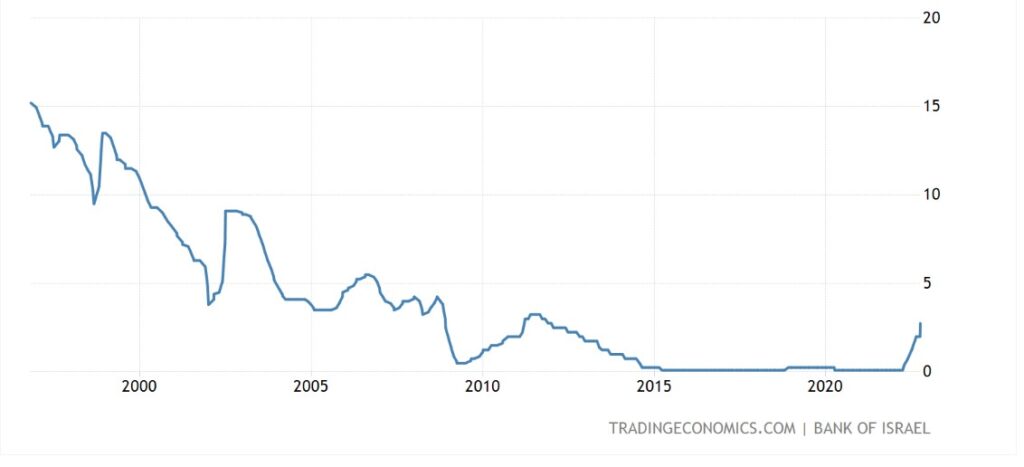

However, these latest developments are not new. Though the level of inflation here in Israel is modest compared to the US and EU (under 5%), it was a different story in the nineties. At that time, inflation peaked in 1991 at 19% and then began to decline, reaching its lowest point in 2000 at 1.05%. It was risky to purchase bonds during that time, but those who did so made a great deal of a return because the negative impact on bond prices allowed for higher yields.

Better evidence for the investment argument for bonds in a high inflation environment can be found in the US between 1979 and 1982. At the time, the Federal Reserve had to act swiftly to raise the interest rates in order to tackle the issue of inflation. However, its pro-active stance stifled the economy and ushered a recession. In 1982 the Chair of Fed had to cut the interest rate in order to get the economy going.

As a result, 1982 was the best year for bonds in decades due to the Fed’s turnaround. People were struggling at the time due to the recession, and the Fed took action. Both the bond and stock markets started out on a successful path that lasted, with some significant breaks, nearly four decades.

Right now, given the combination of factors that led us to this economic crisis, it is virtually impossible to see a similar turn around. Though the bond market’s losses are likely mostly over, the economy, especially in the US as it remains the engine of the world economy, is still slowing down, and the effects on millions of individuals are still being felt. According to some economic readings, the recent interest rate hikes are beginning to feed through. Mortgage rates are already above 6%, housing market has been showing signs of weakness and consumer confidence has been hit.

Therefore, in order to avoid more disruptions, it is a good time to ensure that there is cash on a side in order to be ready to take advantage of the investment opportunities, whether it be bonds or undervalued stocks.

Having said that, there are plenty of causes for optimism. We are certainly closer to the bottom of this financial downturn, and eventually, the devastation of this year will likely start reversing. Therefore, remember to keep a long-term perspective in mind, as from a historic stand point, these are the type of investors that tend to succeed.

0 Comments