Housing prices in Israel have risen rapidly over the last five years. It would be less surprising if this phenomenon was limited to Tel Aviv and its suburbs, but when the national average rise reaches 37%, it just emphasizes the extent of the recent property market boom and its role as an investment vehicle.

However, property is not the only avenue for investment in Israel. When it comes to long-term investments, the stock market has a good track record. Whether or not you should invest in the stock market or in property is a valid question. Therefore, we decided to compare both.

To avoid overcomplicating matters, we will examine the passive form of stock market investing — purchasing index trackers, or ETFs that mirror the Tel Aviv 125 index (TA-125).

But before we get into it, there are a few things that need to be covered so that a potential investor can make an educated decision about the two investment strategies.

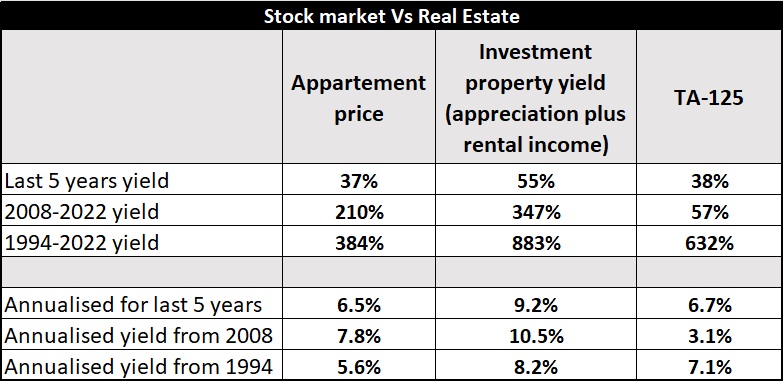

We will compare the return on investment in both sectors from 1994 to 2022, when housing data became available, between 2008 and 2022, when property market growth accelerated, and over the last five years.

Also, when comparing the real estate and stock market returns, there has to be a distinction within real estate because apartments could be bought as residential or investment property.

According to data published by Bizportal, apartment prices in Israel increased 37% over a five-year period, or 6.50% on an annual basis. During the same time frame, the Tel Aviv Index 125 increased by 38%, or 6.7% on an annualized basis. The returns on residential properties purchased for investment purposes that include rental income, on the other hand, were significantly higher. Its yield has risen by 55% in the last five years, or 9.2% annually.

It has to be noted that in the last five years, the housing market in Israel has experienced accelerated growth. Rarely does a yearly increase of 20% happens as it did in 2022. It is typically between 2% and 4% (with an additional 2%-3% in yield if it is an investment property). In contrast, the stock market experienced three negative years during the same time span (2018, 2020, and 2022). Despite this, the TA-125 return exceeded that of residential property buyers. However, its yield is lower compared to the returns generated from investment properties.

On a related but distinct note, the strengthening of the shekel benefits potential foreign investors interested in investing in Israel. Over the last five years, the shekel has gained 20% in value relative to the US dollar.

Looking at the time period beginning in 2008 and ending at the end of last year, the yields on both residential and investment properties (at 210% and 347%, respectively) far outpaced the yield on TA-125, which increased by a more modest 57%. To avoid giving the impression that property prices in Israel increase by leaps and bounds on a regular basis, the real estate market struggled from 1997 to 2007, with prices falling by 15-20%.

When looking at data from 1994, the picture changes dramatically: investment property is a clear winner, yielding 883%, while the stock market returned 632% and the average price of residential property gained 384%.

So, there is no doubt that investing in Israel, whether in real estate or the stock market, is clearly worthwhile. Those who chose investment real estate as their preferred investment strategy have come out on top over the last 29 years.

Will this pattern continue in the coming years?

There are too many variables at play to provide a clear-cut answer. For starters, the golden age of cheap finance has passed. This will undoubtedly have an impact on the property yields in a foreseeable future. Fewer buyers will be willing to borrow money as mortgages become more expensive. Furthermore, financial institutions are working hard to attract new clients by providing fixed income alternatives, making property investing less appealing. Therefore, these two factors alone have the potential to stall housing prices and even cause a change in direction. In light of this, it is difficult to see property sentiment remaining at the levels seen a year ago. However, if the Bank of Israel reverses its policy of raising interest rates, the situation may begin to improve.

What about the stock market?

It is important to remember that investing in the stock market, particularly when talking about passive investing, requires little effort on the part of the investor. Furthermore, there is no need to have large sums of money in order to get involved. And when comparing the long term returns of TA-125 and real estate, stock market comes out with a very decent performance. There is one thing to remember when getting involved with it: don’t let panic get the best of you when the market falls, but instead stay the course. Or, to paraphrase the well-known investor Peter Lynch, “The real key to making money in stocks is not to get scared out of them.”

0 Comments