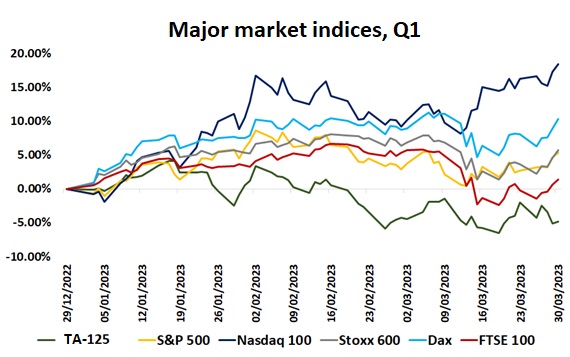

The Tel Aviv stock market’s performance during the first three months of 2023 has been quite disappointing. According to IBI, one of the leading investment houses in Israel, the main indices in Israel (TA-35 and TA-90) underperformed in comparison to indices in Europe and the United States, and this occurred against the backdrop of concerns regarding the legal reform’s repercussions. While the Stoxx 600 in Europe and the S&P 500 in the United States generated returns of 7.8% and 7%, respectively, the TA-35 and TA-90 exhibited declines of 3% and 7%, respectively.

Liran Lublin, the Head of Research at IBI, stated that due to the industry’s sensitivity to interest rate increases, the Tel Aviv real estate index exhibited the greatest underperformance during the first quarter of the year, falling approximately 14%. In contrast, the oil and gas sector has outperformed the market by approximately 13% since the beginning of the year, with the acquisition offer for 50% of NewMed Energy’s shares being the primary factor.

During the first quarter, the trend of redemptions from equity mutual funds gained momentum and peaked in March. Lublin points out that, contrary to what happened in 2020, institutional investors are now moving money overseas due to political unpredictability. This is a trend that is making the local stock market decline.

In the banking sector, global banking suffered from instability during the quarter after the failures of SVB, Credit Suisse, and Signature Bank. Although good results were reported by the Israeli banks, political uncertainty and panic in the global banking sector caused a lack of performance in comparison to the European banks. Beinleumi Bank, which had a negative return of about 7%, led the declines in the local banking industry, with Mizrahi Bank being the only institution to have a positive yield of slightly less than 1% in the first quarter.

In the gas and oil sector, the Abu Dhabi National Oil Company and BP’s offer to buy 50% of NewMed Energy’s shares last week led to an increase in its share price of about 40%. This resulted in substantial price increases and high trading volume in the other shares of the sector as well. In comparison, the Tel Aviv Oil and Gas index delivered a gain of 13% in Q1, whereas the energy sectors in the US and Europe fell by about 5.5% and about 2%, respectively.

The Tel Aviv Real Estate Index decreased by approximately 14%. The main reason for the underperformance of the Tel Aviv Real Estate Index compared to the other indices in Israel is the interest rate increases that weigh heavily on the shares of the real estate companies. Thus, the financing expenses of real estate companies (which is considered a more leveraged sector compared to other sectors) have increased significantly in the last year.

In the last six months, yielding real estate companies have reported a toughening of tenant negotiations, which is reflected in office rental prices showing a tendency to decrease. In recent months, the subleasing market has gained momentum, which has also contributed to the decline in prices. In the residential real estate market, rising interest rates led to higher mortgage rates and a decline in demand for apartment purchases.

In comparison, as highlighted by Lublin, the technology sector performed better than Tel Aviv’s leading indices, but significantly worse than those in the U.S. and Europe, which rose by around 21%. The Israeli technology sector finished the quarter with a return of -1%, led by Perion Network (+61% from the beginning of the year in response to strong reports and optimistic expectations regarding the contribution of artificial intelligence to the company’s partnership with Microsoft Bing). In contrast, Liveperson’s share price plummeted by 54% in response to particularly poor quarterly reports. Despite the outperformance of Israeli technology stocks relative to local indexes, from a global perspective, Israeli technology companies did not benefit from the industry’s significant gains attributed to AI developments and specifically the launch of ChatGTP.

What can we expect next? Based on the data available, it seems that the political uncertainty in Israel will remain one of the main factors influencing stock market performance and, consequently, a broader economy in the near term. Institutional investors are diverting funds overseas, and the trend of redemptions in equity mutual funds is gaining momentum. As for the real estate sector, the interest rate increases will continue to affect the shares of the real estate companies, and this segment of the market may continue underperforming in the future. On the other hand, the gas and oil sector may continue to perform well in the near future, especially in light of the latest OPEC+ move to cut the production of oil. As a result, it is in the hands of Israel’s government to resolve the current crisis as soon as possible in order to avoid any potential damage not only to the capital markets but also to the country’s financial stability.

0 Comments