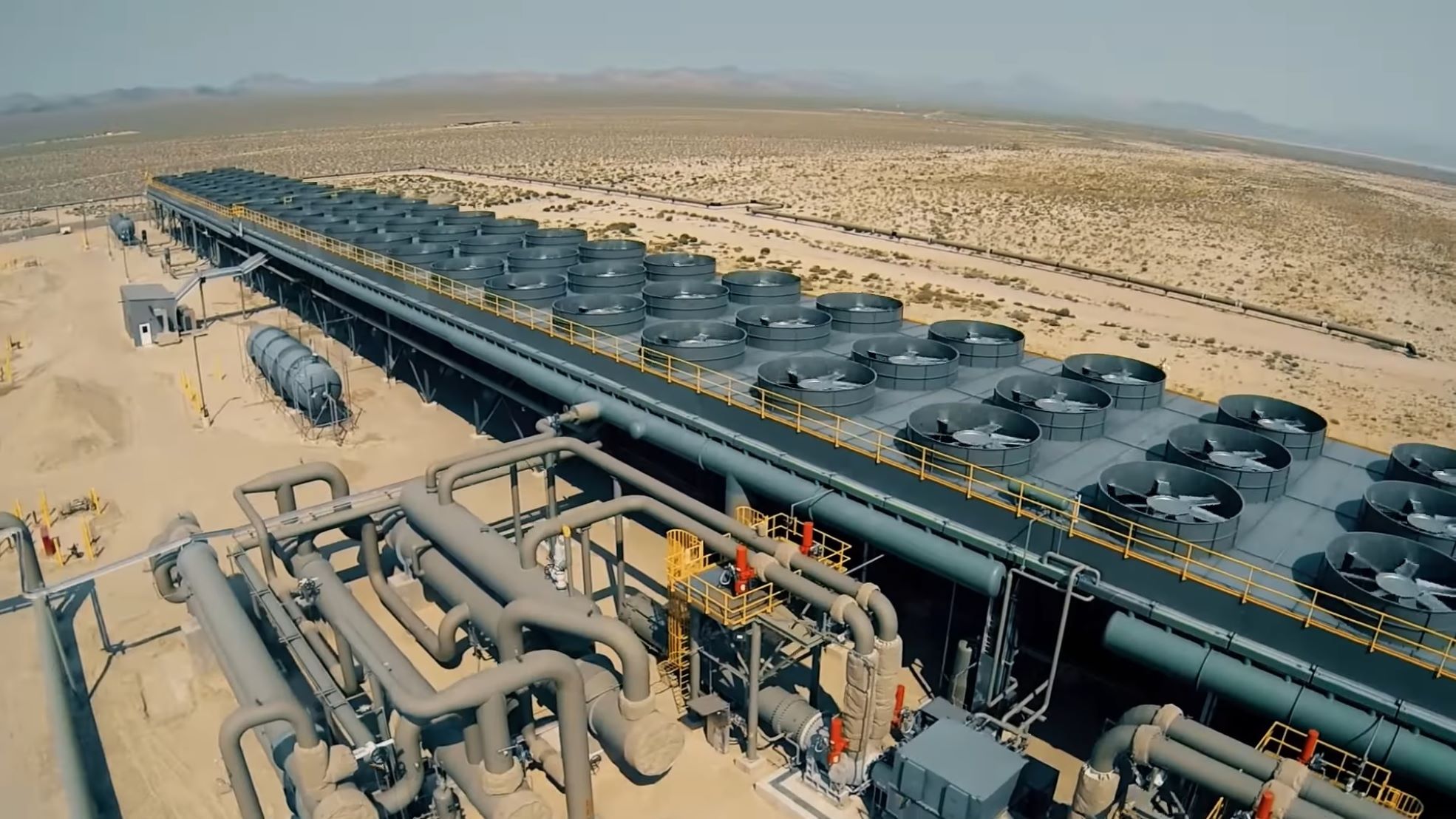

Israeli firm Ormat Technologies Inc. (NYSE: ORA), a market leader in the geothermal, energy storage, solar PV, and recovered energy power industries reported Q3 financial results.

The company exceeded the market’s expectations over key parameters. Revenue for the period came in at $175.9M versus the consensus estimate of $167.69M and earnings per share of $0.33, which is $0.06 better than the analyst estimate of $0.27. Expansion of revenue and operating profits were caused by new power plants and high energy prices

Doron Blachar, Ormat’s Chief Executive Officer said the following, “Ormat’s third quarter financial performance demonstrated strong growth in the top-line, driven by continued momentum in electricity and energy storage segments along with a notable improvement in our product segment. Our fourth consecutive quarter of top-line growth drove expansion in both our operating income and net income”.

“We continue to see strong global tailwinds for renewables, specifically in the USA and Indonesia. The elevated global price environment for fossil fuels and increased focus on energy security supports our long-term plans to increase our combined geothermal, energy storage and solar generating portfolio to approximately 1.5 GW by 2023 and to deliver an annual adjusted EBITDA of approximately $500 million on a run-rate basis towards the end of 2022”, added the CEO.

Per the company’s dividend policy, on November 2, 2022, the board of directors declared, approved, and authorised payment of a quarterly dividend of $0.12 per share.

Ormat Technologies sees FY2022 revenue of $720-735M, versus the consensus of $630-638M.

0 Comments